Introduction

Real Property Gains Tax (RPGT) 2025 is something that we as experienced property investors or as property owners, hoping to sell, can ill afford to overlook. RPGT has always been an important instrument in determining the mode and timing of selling property in Malaysia since it was introduced as a tax on the profit earned in the sale of property. And now that the new updates have been announced in Budget 2025 Malaysia, the rules have changed once more.

What then does that mean to us?

In essence, RPGT 2025 in Malaysia is intended to reduce speculation and stabilize the property market. It levies on the capital gains (profit) which we earn by selling real property- basically, the difference between the price we sell the real property and the amount we initially bought it at. However, the structure and rates have changed over the years particularly as regards individual home owners, companies and foreign investors.

You may also need to know the hidden cost when buying a house in Malaysia,

Major RPGT Changes in Budget 2025

Among the largest shakings in 2025 are the new exemptions and more exact timelines. As an example, the new rules have enabled the Malaysian citizens and permanent residents to obtain full exemption of RPGT 2025 on profits made by disposing of residential properties which have been owned more than 5 years, something that will encourage long-term ownership. This is good news to most of us who have not been speculating, but have been owning properties as family houses and as long term investments.

Short-Term Flipping Faces Higher Tax Rates

On the other hand, we flippers who perform such operations in a short holding period, might be subjected to a more highly taxed rate. This is to prevent the short term speculation and develop a more sustainable people oriented housing market.

To get this into perspective, suppose we purchased a unit in a condo in 2019 and sold it in early 2025. Our Real Property Gains Tax Malaysia rate may vary between 5-30% depending on the month of disposal and duration of time we held the unit and our net gain would be substantially influenced. To developers, companies and non-citizens the structure becomes even stiffer with less exemptions possible.

We will also showcase in this guide, the new RPGT 2025 rules and regulations, how to compute your tax, who is exempted and most importantly, how it will impact your real property strategy in Malaysia. This is the knowledge you need whether you are selling your first house or auditing an expanding portfolio.

What Is RPGT in Malaysia and How It Works

Whether you have sold a property in Malaysia before (or will be doing so), you are probably familiar with the term RPGT, or Real Property Gains Tax. However, the real meaning and operation of RPGT in 2025 are the most important factors that need to be considered when making decisions, given the new adjustments that have been made in terms of the Real Property Gains Tax Malaysia Act and the Budget in 2025 Malaysia.

Then, what is RPGT Malaysia 2025 about?

A Quick Breakdown

Real Property Gains Tax Malaysia is a duty that is levied on the gain (or profit) on sale of any real property. These comprise landed property, condominiums, trade premises and even stocks in real property companies (RPCs). The gain is computed by the difference between the price of the property at disposal and the initial purchase price of the property-less any allowable expenses such as legal expenses, renovation costs and agent commissions.

Consider it in this way, say we purchased a property worth RM500,000 and sold it off at RM700,000, our gross gain would be RM200,000. The taxable amount may still be reduced after allowable deductions but that is the amount that RPGT is applied on.

Origins & Purpose of the RPGT Act

The Malaysian government has come up with RPGT Act 1976 to check the over speculation of properties which might give way to housing bubbles and affordability problems. The market was volatile then as the prices of properties skyrocketed and investors who would flip properties in quick succession. Real Property Gains Tax Malaysia was intended to promote more long term and stable ownership.

RPGT has been amended numerous times over decades to be in line with the current economic conditions. In certain years it was suspended altogether; in others rates were raised to a higher level by way of discouraging short sales. The 2025 changes will be designed to create a balance- allowing strict protections to the true homeowner and curtailing the speculator.

How RPGT Works in 2025

In 2025, the RPGT structure is more targeted:

- Malaysian citizens and permanent residents are fully exempt from RPGT if they dispose of residential property after the 5th year of ownership.

- Properties sold within the first five years are taxed progressively— ranging from 30% (within 3 years) to 15% (in the 5th year).

- Companies and non-residents, however, continue to face RPGT even after five years, typically at a fixed 10% rate.

- There are also specific exemptions for one-off disposals and transfers between family members under certain conditions.

Knowing this structure gives us a chance to time our sales, which costs to monitor, and how to structure our property investments so as to gain maximum profit at the lowest tax.

RPGT 2025 Updates from Budget 2025

Budget 2025 Malaysia introduces changes to the RPGT 2025, which are quite significant and every property owner and investor should take note of. Although the fundamental structure of the Real Property Gains Tax Malaysia tax is unchanged, the government has also put in place important amendments to enhance compliance and to simplify the process of making returns.

Key Changes in RPGT 2025

The most remarkable change is the implementation of a self-evaluation mechanism of RPGT filings, which will come into effect on 1 January 2025. What this implies is that property disposers either on an individual or company basis will now be required to compute their own RPGT liability, as well as file proper tax returns within the specified time frame.

In the past, the calculations and assessment of RPGT were mainly checked and confirmed by the Inland Revenue Board (LHDN). With this new method however, the responsibility is imposed on the seller just like in the case of income tax in Malaysia.

Along with this, RPGT returns should now be filed within 60 days of disposal date and the disposers should disclose all the necessary information such as the cost of acquisition, price of disposal and the expenses that can be incurred.

What This Means for Property Owners & Investors

To us, the active participants in the business of buying and selling property, this transformation will underline the importance of improved record-keeping, proper documentation, and financial openness. It also places us in better control of the process but with this comes increased accountability.

In the event that we intend to sell in 2025 or later, it is important that we prepare early: follow renovation expenses, legal charges and S&P dates, etc. False reporting might lead to fines or unsatisfied transactions.

To sum up, RPGT 2025 is not only about new rates but also about new burdens. And there will be no better way to ensure maximum returns and compliance than to be kept informed.

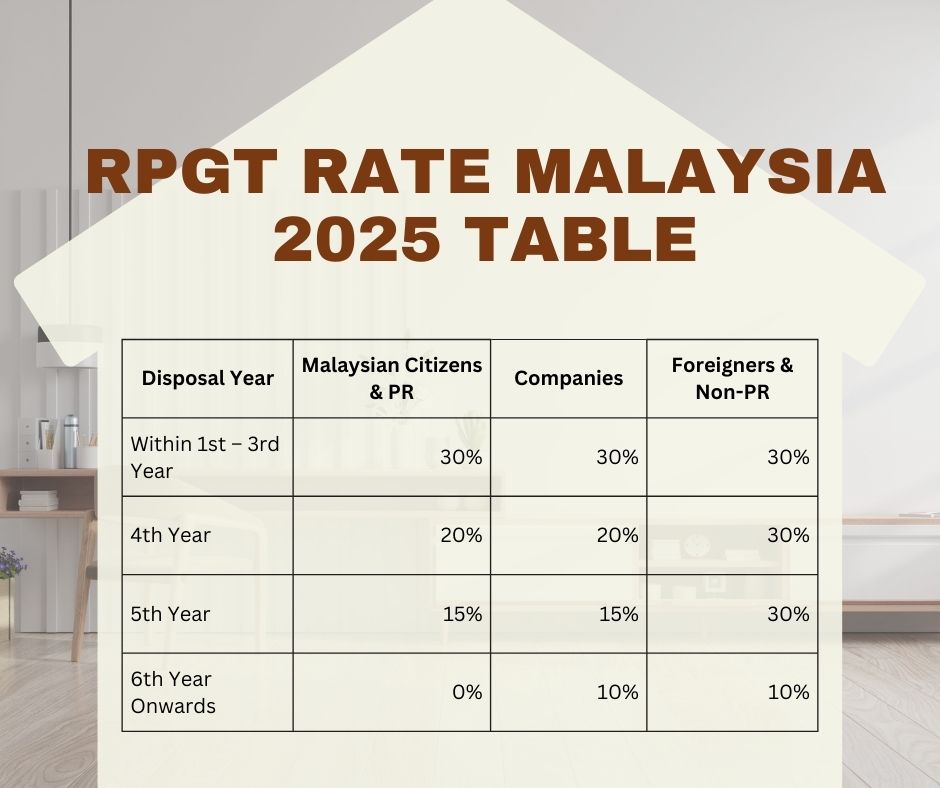

RPGT Rates in 2025 (For Citizens, Companies & Foreigners)

It is crucial to know about the current RPGT rates in 2025 to those who intend to sell the property in Malaysia. As citizens, as a property-holding company, or foreign investors, the Real Property Gains Tax (RPGT) Malaysia 2025 charges us differently based on our residence and the length of possession of the property.

Below is a quick breakdown of the updated RPGT tax structure:

RPGT Rate Malaysia 2025 Table

What These Rates Mean for Us

To Malaysian citizens and permanent residents, the most important lesson is that we are entirely exempted from RPGT Tax after the 5th year- a significant factor to long-term holding of properties. However, with a 30% tax rate involved, we could lose a lot of profits in case we sell in the first 3 years.

The firms, however, have a steady tax regime, which gradually decreases beyond the 5th year, but does not reach zero. This is what we have to think about when we have a business entity and we are doing the management of property.

It is more stringent to foreigners and non permanent residents: a flat rate of 30 percent RPGT Tax is applicable on any disposal within the first five years and a 10 percent tax is still there even after the five years. Those rates demonstrate the desire of the government to control the speculative purchases of foreign properties and maintain local ownership affordable.

Having an idea with whom we fit in will make us plan more intelligent exits, reduce tax liabilities, and maximize on returns through each property sale.

RPGT Exemption 2025 – Who Qualifies?

It is tempting when selling a property to consider the amount of tax we might have to pay but what most of us do not know is that there are the RPGT exemptions which can reduce our tax burden drastically or even waive it completely. Some types of property disposals in Malaysia remain RPGT exempted in 2025 and this brings great relief to the property owners, families and the lower-income bracket.

Who qualifies? Let us break them down.

1. One-Time Residential Property Exemption (For Malaysian Citizens)

Being a Malaysian, we are privileged to have a one-off RPGT exemption 2025 on the sale of a property that is a private residential property. This implies that we can claim a complete exemption of any capital gains that we make on a house, condo or apartment that we have lived in (or were to be lived in) but we can do it only once.

This exemption is only to the person (not to the company) and to one residential unit to a person. Therefore, in case we are a couple, we can all make use of this exemption individually, as long as we own different properties.

2. Transfers Between Family Members

There is also another significant exemption, which concerns the transfer of property among family members who are close ones. Such includes transfers between:

- Spouses

- Parents and children

- Grandparents and grandchildren

In such, RPGT is not levied on the ownership transfer and no gain no loss is treated to have been made on the transaction. So in case we are gifting a house to our child or spouse, there is no RPGT at all.

3. Exemption for Low-Cost Housing

Low- and medium-cost housing properties can also be subject to RPGT exemptions, but only in accordance with the state policies, and under the condition that the disposal is not a part of the state project. Although this is not automatic to all low-cost units, it should be checked with LHDN or your legal counsel when selling such property.

If you qualify, you may apply here.

Why These Exemptions Matter

These exemptions are not mere technicalities, but rather a policy choice to assist real home owners and families as opposed to speculators who are merely in it as a short term game. Knowing how to use them and applying them minimizes our exposure to taxation and also makes us more in line with the government stimulus towards long-term property ownership.

It is worth checking whether we qualify before we go and click on the sell button because you could save tens of thousands of tax.

How to Calculate RPGT in Malaysia

Knowing how to calculate RPGT in Malaysia is important to an individual intending to sell a property and make the best profits. The formula is simple enough, but the devil is in the detail, particularly in what type of expenses may be claimed as well as what rate of RPGT may be charged.

RPGT Calculation Formula

Here’s the basic formula we use:

RPGT = (Disposal Price – Acquisition Price – Allowable Expenses) × RPGT Rate

- Disposal Price: The selling price of the property (or market value, whichever is higher)

- Acquisition Price: The original purchase price of the property

- Allowable Expenses: Costs like legal fees, stamp duty, renovation, advertising fees, and agent commissions

Sample Scenario

Let’s say we bought a condominium in 2020 for RM500,000. We’re selling it in 2025 for RM700,000. Along the way, we’ve spent:

- RM10,000 on legal & agency fees

- RM20,000 on renovations

- RM5,000 on advertising and marketing

Here’s how we calculate the RPGT:

- Disposal Price: RM700,000

- Acquisition Price: RM500,000

- Allowable Expenses: RM35,000

Chargeable Gain = RM700,000 – RM500,000 – RM35,000 = RM165,000

Since we’re disposing of the property in the 5th year, and we’re Malaysian citizens, the RPGT rate in Malaysia is 15%.

RPGT Payable = RM165,000 × 15% = RM24,750

Therefore, our net profit after tax would be RM140,250 in the given case.

By monitoring all the permissible expenses and knowing what RPGT rate of Malaysia 2025 is, we are able to pay a lot less tax on this and be wiser when planning to sell a property.

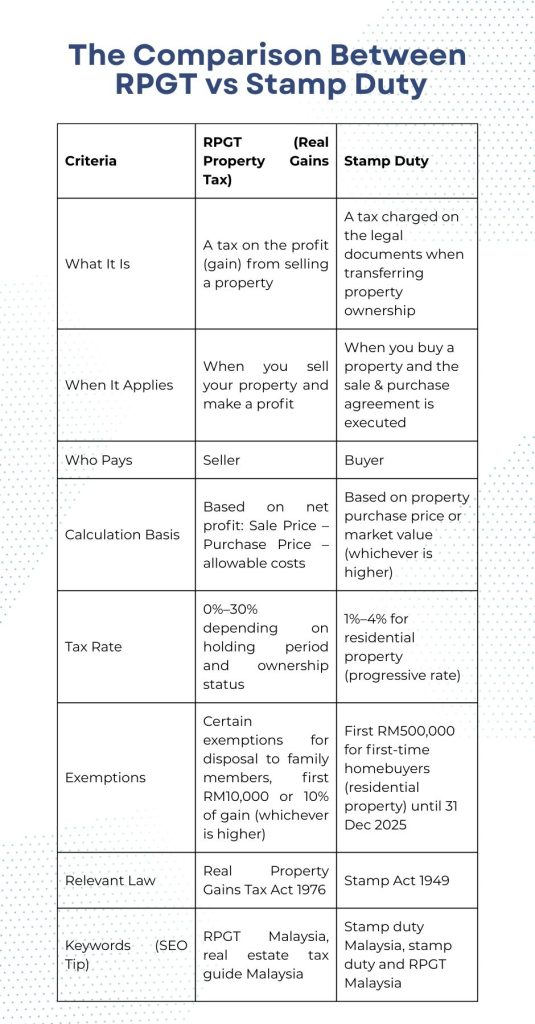

RPGT vs Stamp Duty: What’s the Difference?

In the property tax environment of Malaysia most of us get confused between Real Property Gains Tax Malaysia and stamp duty Malaysia. Although both are government fees on property dealing, they are imposed on different individuals at various stages in the transaction. The knowledge of the difference will enable us to know how to budget our money and not be caught by surprise at the signing table.

When Does Each Tax Apply?

- When a property is sold at profit, the seller is charged RPGT (Real Property Gains Tax). It is a tax on gain (or profit) of the property. Therefore, in the case that we are the sellers of the house, we are the ones who will pay Real Property Gains Tax Malaysia – this is calculated on the basis of the duration we have owned the house and our residency.

- Stamp Duty is however paid by the buyer. It is a tax on the legal documents transferred in order to transfer ownership, which is calculated depending on the price of the property based on the market value of the property or the purchase price (whichever is greater). Stamp duty Malaysia will still be payable on signing of the Sale and Purchase Agreement (SPA) even though it may not be a profit sale.

A Simple Real Estate Tax Guide for Sellers

If we’re selling a property in Malaysia, here’s the tax situation in a nutshell:

- RPGT: Applies to us (the seller), based on profit made

- Stamp Duty: Paid by the buyer, not our concern as sellers—but it can influence buyer decisions

Understanding both taxes allows us to price our property more strategically and anticipate our net profits more accurately. While stamp duty in Malaysia might not directly affect our wallet as sellers, it certainly plays a role in how attractive our property is to potential buyers—especially in a competitive market.

RPGT for Property Investors: What You Need to Know

Because we are property investors, we always want to get the best out of our investments and at the same time ensure we have little risk in our investments and that is why we want to know how Real Property Gains Tax Malaysia can be incorporated into our property investment strategy in Malaysia come 2025. There are new tax rates and rules that have been updated and this is the best time to plan tax wise as a house dealer.

Holding Period Matters – A Lot

Holding the property longer is probably one of the best strategies that we can implement. In its present form under RPGT 2025, the Malaysian citizens have zero percent taxation after the 6 th year of ownership. Then consider that this is a hefty 30 per cent in case of a sale in the first three years, and the incentive to wait is obvious.

RPGT can significantly cut our profits in case we intend to make short-term profits through flipping. However, when we concentrate on the medium-to-long-term investments, particularly in growth corridors or regions where renting is relatively more acceptable, then we cut our tax exposure and leave the property values to rise more organically.

Legal Ways to Minimise RPGT

We’re not just stuck paying RPGT—there are legal ways to reduce it:

- Claim all allowable expenses: Renovation, legal fees, valuation costs, commissions, and even advertising—all deductible.

- Utilise one-time exemptions: If we haven’t used our personal exemption yet, timing it with a profitable sale can save us thousands.

- Family transfers: Structuring property transfers as family-related (spouse or children) can qualify for RPGT exemption 2025 in many cases.

Finally, keep clean records and receipts. As we are the ones to report about the new self-assessment RPGT system that will take place in 2025, the better we prepare, the more we save in our pockets.

And to us who are serious with property investment in Malaysia, then it is not an option but a must to understand and plan around RPGT.

Frequently Asked Questions (FAQ) – RPGT Malaysia 2025

The RPGT Act and all the rules may be complicated to navigate through and comprehend, given the changes in Budget 2025. In an attempt to make this process easier, here are some of the most frequently asked questions that we received by property owners and investors: answered simply and to the point.

1. Do I need to pay RPGT if I sell after 5 years?

It will depend on whether you are in a position.

As a Malaysian citizen or permanent resident, you do not pay any RPGT after the 6 th year of ownership, your rate reduces to 0 %. However, where you sell in the 5 th year you are still liable to RPGT at a rate of 15%. However, foreigners and companies still have to pay RPGT after 5 years (normally 10 %).

2. Can I get an exemption?

Yes. Several RPGT exemptions in 2025 still apply:

- One-time residential property exemption for Malaysian citizens

- Transfers between close family members (spouses, parents, children, grandparents, grandchildren)

- Certain low- and medium-cost housing sales under government programs (≤ RM200,000 housing plan)

3. How long does the RPGT refund take?

Normally, RPGT refunds where the form is submitted may take 30-90 days to be refunded but this may vary based on documentations and speediness of filing the CKHT 3 form (RPGT return). Maintaining all the receipts and records will be up to date to accelerate the process.

4. Where can I check my RPGT or stamp duty payment status online?

To know your payment status, you can log into the MyTax portal (https://mytax.hasil.gov.my) using your account. You will be able to check your tax transactions, filing history and payment updates of RPGT and stamp duty Malaysia there.

5. Do I pay RPGT if I transfer property to a family member?

No provided that it is a qualified family transfer i.e. to or from your spouse, parent, child, grandparent or grandchild, the disposal is taken to be at no gain and no loss, and RPGT is not charged. All you need to do is to send the right documents when making the transfer.

As we have seen all through this guide, RPGT 2025 is vital in determining how we deal with the sales of property in Malaysia. As new home owners or as seasoned investors, there is a lot to know about the Real Property Gains Tax Malaysia, its rates and exemptions and filing requirements and knowing them is likely to save us a lot in our net returns.

As new rules are introduced in Budget 2025, particularly in the transition to a self-assessment regime, it is increasingly essential to be kept abreast and organised. Portfolio selection to holding period methods, every little choice can result in a significant reduction of taxes.

With that said, the tax laws may be complicated and dynamic. This is why we had better consult with a licensed tax advisor before we sign a Sale and Purchase Agreement or before we transfer the title of the property to a new owner. Seeking the right advice in the initial stages will make us compliant, keep us out of penalty, and help us to maximize every property transaction.

Conclusion

As we have already discussed in this guide, RPGT 2025 is an important aspect that influences our approach to sales of properties in Malaysia. As first-time home buyers or even as an old-time investor, knowledge of the pen and parcel of the Real Property Gains Tax Malaysia, including rates and exemptions, and filing requirements can help us reap big in our net returns.

As the rules are updated as per the Budget 2025, notably, a move to self-assessment regime, it is more prudent than ever before to stay informed and organised. Whether it is allowable expenditures or the holding period tactics, even minor decisions might contribute to significant tax savings.

With that said, tax laws may be complicated and dynamic. Therefore, signing a Sale and Purchase Agreement or transferring the ownership of property would always be prudent to seek the advice of a licensed tax advisor. Proper guidance at the beginning keeps us within the law, prevents any penalties and makes the best of any property deal.